In the wake of digitalization, E-Commerce has emerged as the most successful sector. Online stores have burgeoned immensely during recent years. And, one of the main contributing factors is the ease of payment online. Business owners can easily accept payments on their site with the help of payment gateways. But, this is also where many get confused about which payment gateway to use. Well, PayPal and Stripe are the two that are at the top of their game. So, the question arises PayPal vs Stripe: Which is one should you choose?

What is a Payment Gateway?

Payment Service Providers such as PayPal and Stripe connect the business owners with merchant accounts to accept payments from the customers. These Payment Service Providers provide payment gateways and technology that allow business owners to authorize online payments on their site.

Basically, they provide privacy and security of the user payment and credit card details in online transactions. They are the medium through which business owners can process customer payments on the website. Therefore, it allows users to make payments online conveniently.

In this WPEverest Article, you’ll learn which payment gateway is the best for you. Everything you need to know about PayPal and Stripe right here. They provide features that are similar and comparable. So, we have reviewed and compared both of these payment gateways considering the main factors.

A Brief Introduction:

Before we get into the comparison of PayPal vs Stripe, let’s take a quick look at a brief overview of both the payment gateways.

PayPal

PayPal is one of the most popular payment gateways that many types of online business owners rely on. It offers multiple pricing plans that the businesses can choose according to their company requirements. However, the PayPal Payment Standard is the most well-received because of its ease of use and cost. You can easily integrate it into your e-commerce site without having great coding knowledge.

Also, you don’t need to pay for any setup costs and monthly fees so, it is the free version. With this, you can accept payments from credit cards, PayPal and PayPal Credit. However, there is one prominent disadvantage i.e. customers will be taken away from our website while checkout. You can tackle this problem by getting the PayPal Payments Pro. But, it includes the monthly fees of $30 per month.

Stripe

Stripe is undoubtedly the most popular payment gateway after PayPal. It allows you to process any major credit card payments on your e-commerce website. Not to forget, it is completely free to set up and there are no monthly fees. It also offers more customization options for businesses with hired personnel who programming knowledge. So, if you are tech-savvy and into programming then, Stripe is the one for you.

It doesn’t offer pricing plans such as PayPal but, you can purchase the extra tools and features it offers. With Stripe you have the advantage of checkout without redirecting customers out of your website. And, there is no extra monthly fee for that.

PayPal vs Stripe: Transaction Fees

PayPal and Stripe both offer the same rate online transactions i.e. 2.9% + 30¢ within the U.S. Other than that there are variations in the fees for Micropayments. These are the online payments which are less than $5.

PayPal Fees

- Transaction (U.S): 2.9% + 30¢ per transaction

- Non-profit: 2.2% + 30¢ per transaction

- Micropayments: 5% + 5¢ per transaction

Stripe Fees

- Transaction Fee (U.S): 2.9% + 30¢ per transaction

- Nonprofit Discount: 2.2% + 30¢ per transaction

- Micropayments: 2.9% + 30¢ per transaction

Therefore, PayPal and Stripe have the same transaction fee rate for normal and non-profit payments. Stripe offers the same flat rate for the micropayments whereas, PayPal offers a lesser fee(5% + 5¢ per transaction). So, it really depends on what kind of payments you are accepting on your website. Smaller businesses will benefit from the lesser micro payments fees.

PayPal vs Stripe: Payment Methods

PayPal

According to the various pricing plans, PayPal offers various payment methods. Depending on the type of payment method you require, you need to choose a pricing plan.

- PayPal

- PayPal Credit

- Credit Cards

- Debit Cards

- Pay by Phone (Virtual Terminal)

Stripe

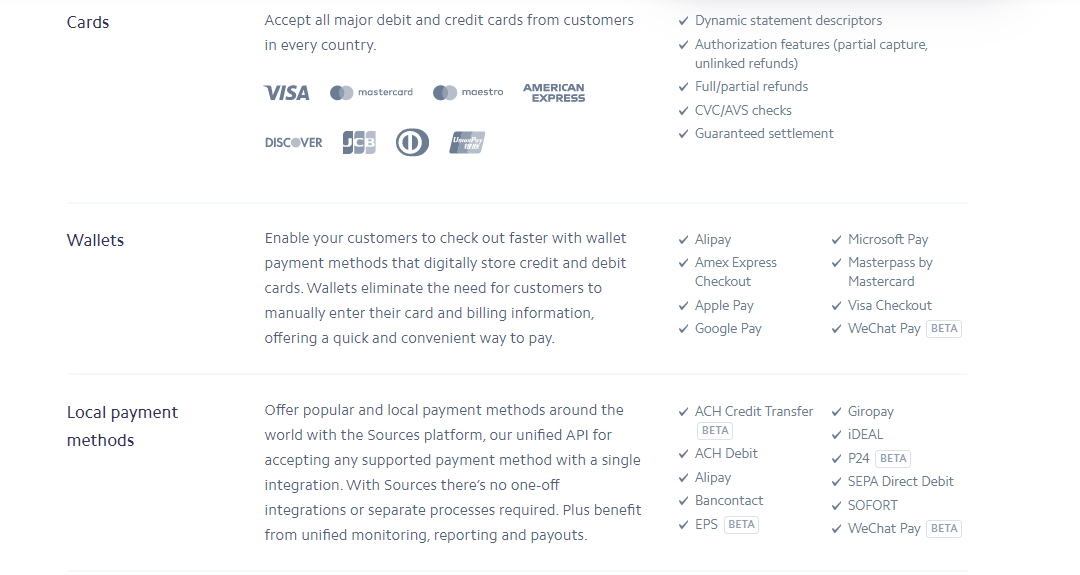

If you want more payment methods for your website, you can definitely choose Stripe as it offers a wide range of options. With Stripe, you can accept major debit cards and credit cards. And, you can also accept payments through digital wallets such as Apple Pay, Google Pay, etc.

- Credit cards

- Debit cards

- International cards

- AmEx Checkout

- Masterpass by MasterCard

- Visa Checkout

- WeChat Pay

- AliPay

- Apple Pay

- Google Pay

- ACH credit and debit

- SEPA direct debit

- And more

PayPal vs Stripe: Chargebacks

Chargebacks are the reversal of the credit card payments which is initiated by the customer’s bank. It protects customers from potential frauds. But, it can be a great hassle for the online store owner. The payment gateways charge the business owners a certain amount as the chargeback fee.

- Chargeback fee of PayPal: $20

- Chargeback fee of Stripe: $15

PayPal vs Stripe: Refund Fees

Starting October 11, 2019, PayPal has stopped returning the transaction fees i.e. 2.9 + $0.30. When you refund a customer or donor on your website, you won’t be charged any fees. But, you will not receive the original processing fees of the online transaction.

Similarly, the case is the same with Stripe; There are no fees for refunds but the transaction fees are not returned.

PayPal vs Stripe: Online Invoicing

Online Invoicing is available for both the payment gateways. While PayPal offers this feature completely free, you need to pay for the invoicing of the transactions after you bill more than $1 million with Stripe.

PayPal vs Stripe: Recurring Billing

There is no recurring billing feature for PayPal Standard. Therefore, PayPal charges a monthly fee of $10 for recurring billing. In addition, the customers in the recurring billing plan can cancel their plan without notifying you.

So, Stripe is the better choice here as it is 100% free and customers cannot cancel their recurring billing plan without your permission.

PayPal vs Stripe: Checkout

PayPal Standard

If you choose the free PayPal option, you’ll face a big problem. During checkout, the customers are redirected to the PayPal account page from your website. This increases the chances of payment abandonment by the customers. But, there is a way to complete the payment without redirecting the customers out of your site. You can upgrade to PayPal Payments Pro.

PayPal Payments Pro

With the pro version, you don’t have to worry about the checkout problem of PayPal Standard. But, do keep in mind that with this you have to pay the $30 monthly fee.

Stripe

With Stripe, your customers can easily make credit card payments without having to leave your website. The payment is completed on the website making payment convenient and effortless.

Also, there are no extra fees or monthly fees for this. Stripe offers these features free of cost.

PayPal vs Stripe: Countries and Currencies Supported

Another factor to determine which payment gateway to choose for your website is the global reach and currencies supported. To expand your business territories, you need to choose a payment solution that is available in countries around the world.

Well, the payment gateway that is available in over 200 countries is PayPal. Which is great if you have customers in various countries. But, if you want to accept all currencies on your E-Commerce site, PayPal may not be the best choice. PayPal supports only about 25 currencies.

Stripe definitely has the upper hand in this as it supports over 135 different currencies. So, this gives a great opportunity for business owners to expand their sales around the world. But, do keep in mind Stripe is only available for 25 countries.

PayPal vs Stripe: PCI Compliance

Payment Card Industry (PCI) compliance is the technical and operational set of standards that businesses need to follow to ensure that credit card data provided by customers are secure.

If you don’t want to deal with the PCI compliance on your own, then you can choose either PayPal Standard and Stripe. They both ensure PCI compliance. However, the PayPal Payments Pro doesn’t deal with it. So, business owners have to work on it themselves.

PayPal vs Stripe: Customer Support

Customer support is another important factor to consider when it comes to choosing a payment gateway for your site. Both PayPal and Stripe have various mediums through which they offer support for their customers.

PayPal

- PayPal offers a knowledgebase that answers the commonly asked questions about payments, refunds, PayPal Mobile App, Products and Services and many more issues relating to PayPal.

- Other than that, there is also the PayPal Community Forum where you can post if you are experiencing any difficulties with PayPal.

- Also, PayPal offers the Email and Live Chat Support to contact PayPal directly and ask any queries.

- You can also get Phone support but, it isn’t always consistent.

- And, you can use social media for PayPal if you want to address your problems or contact them publicly @AskPayPal in Twitter

Stripe

- Stripe also offers a knowledge base that answers the questions you have about your stripe account and other issues. You can search for articles relating to your problems.

- As Stripe is extremely developer-friendly, it offers comprehensive documentation for developers that focuses more on the features.

- It offers Freenode-based chat for its users to get in touch with the developers for the technical issues.

- There is also the Live Chat Support that the users can use through their Stripe account. Email Support is also there for not so urgent questions and queries.

- Stripe also offers Phone Support. The user needs to request to get a call back from Stripe.

- And, you can use social media for Stripe if you want to address your problems or contact them publicly @Stripe on Twitter.

Which One Should you Choose?

According to the number of transactions and sales of your business, you can choose either of the payment gateways. Small businesses with no access to developers can simply choose PayPal. PayPal is better for the businesses that accept more microtransactions too. For bigger businesses that want to promote their brand and want more customization, Stripe is the best option.

The truth is, you can use both. If you’re a business that has a wide range of customers all around the world, you can integrate both PayPal and Stripe for your site. There are many companies out there that use both payment gateways. Nevertheless, you can choose either one as per your requirements.

You can easily integrate both the gateways to your WordPress. There are various plugins available to help accept payments on your site with PayPal and Stripe. And, Everest Forms is one that you can use to integrate both. The Everest Forms PayPal Standard and Stripe Add-ons are super easy to use and allow you to accept payments effortlessly.

![Zakra 3.0 | Zakra Pro 2.0 Release [Major Updates!]](https://i.ytimg.com/vi/g3rifl7kWvg/maxresdefault.jpg)